A Rate Cut Bonanza

September 22, 2025

The Bank of Canada Sees Less Inflation

October 6, 2025 Last week Statistics Canada confirmed that our economy did a little better than expected in July.

Last week Statistics Canada confirmed that our economy did a little better than expected in July.

Our GDP growth increased by 0.2% month-over-month in July, led by a 0.6% month-over-month bounce in tariff-impacted goods industries. (Reminder: Our GDP prints lag because it takes time to compile the data.)

That was welcome news. Our GDP decreased by 0.1% month-over-month in June and had contracted for three consecutive months.

In the US, the Bureau of Economic Analysis revised its initial estimate for US GDP growth in Q2 from 3.3% to 3.8%, with most of the bump attributed to stronger-than-expected consumer spending.

Any celebrations may be short-lived because it appears that the US federal government will shut down this week unless Congress passes a last-minute spending package to keep the lights on.

While budget fights and government shutdowns are a somewhat regular occurrence in Washington, this seems like an especially bad time for the US economy to be hit with another self-inflicted wound.

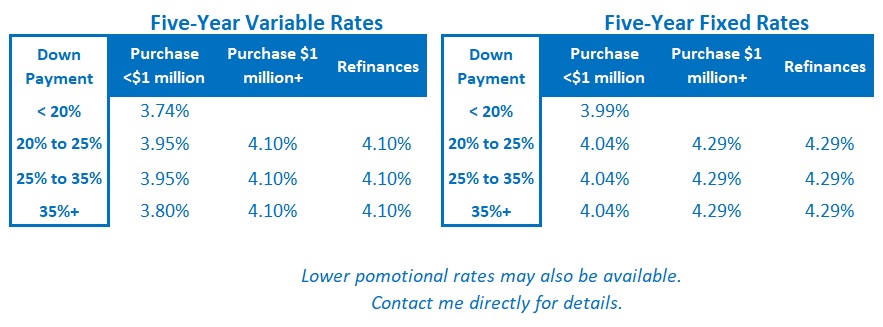

The Latest on Mortgage Rates

Fixed Rates

Bond yields resumed their upward march last week as bond-market investors pared back their bets on the timing and magnitude of Fed rate cuts to come.

In a speech last Tuesday, US Federal Reserve Chairman Jerome Powell highlighted the conflicting challenges of weak employment and above-target inflation. His comments cast doubt on the view that more near-term Fed cuts are a foregone conclusion.

The Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, were pulled higher by the US Treasury equivalents but not by enough to affect fixed rates yet.

Variable Rates

Variable-rate discounts were unchanged last week.

I continue to expect more Bank of Canada (BoC) rate cuts ahead.

While our return to positive GDP growth is encouraging, our Q3 GDP is still only tracking at about 0.9% on an annualized basis. That’s barely above stall speed.

Trade uncertainty continues to weigh heavily on our economy, and the BoC won’t be helping to stimulate growth until its policy rate falls from its current level of 2.50% to 2.0%.

Insider’s Tip for Borrowers

If you want to secure a mortgage pre-approval, your broker will need to include your credit report with your application.

Many borrowers worry that this “hard pull” will negatively impact their score. But unless you’re applying for credit all over town, the impact is negligible.

This post explains how credit scores are calculated. It should also help demystify concerns about the impact that a normal-course-of-business credit pull has on a good score.

My Take on Today’s Most Popular Mortgage Options

My assessment has not changed for a while now.

Fixed rates are offered at about their long-term average levels.

Right now, the best available three- and five-year fixed rates are both good options. If these rates remain roughly equal, I think five-year fixed-rate terms offer slightly better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full term, and I expect the BoC to enact more rate cuts over the relatively near term.

Anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and, in some cases, higher payments) should my forecast prove incorrect.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.