Is Another Bank of Canada Rate Cut on the Way?

October 27, 2025

Canadian Employment Growth Surprises Again

November 10, 2025 Last week the Bank of Canada (BoC) reduced its policy rate by another 0.25%, from 2.50% to 2.25%.

Last week the Bank of Canada (BoC) reduced its policy rate by another 0.25%, from 2.50% to 2.25%.

In its accompanying commentary, the Bank indicated that additional near-term rate cuts are unlikely, despite its own downbeat economic projections:

- It forecasted our GDP to increase by only 2% in 2025, 1.1% in 2026 and 1.6% in 2027.

- It assessed that US trade actions are “having severe impacts on targeted sectors” and are creating heightened uncertainty across our broader economy.

- It acknowledged that there is only so much that monetary policy can do to counteract the negative impacts from US trade actions because the concomitant changes to our economy are structural (i.e. permanent) rather than cyclical (i.e. temporary fluctuations).

Some market watchers were surprised that our weakening economic backdrop wasn’t enough to keep the BoC on a dovish footing. Instead, the Bank assessed that its policy rate is now “at about the right level” if inflation and economic activity “evolve broadly in line” with its latest projections.

When asked what it might take to change the Bank’s mind, BoC Governor Macklem responded that it will take an “accumulation” of evidence to cause the Bank to alter its current assessment.

In conclusion, it sounds as though either our GDP will need to be tracking at or below 1%, or inflation will need to fall below 2%, and stay there, before the BoC might consider an additional cut.

Regardless of how things evolve, it will take time for new data to accumulate, so at a minimum, more near-term rate cuts now appear to be off the table.

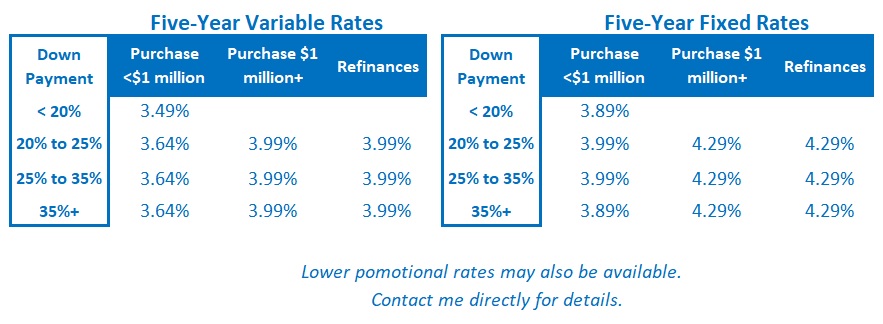

The Latest on Mortgage Rates

The Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, moved a little higher last week.

That surprised a lot of mortgage borrowers who expected them to drop in response to the BoC’s rate cut last Wednesday. But bond-market investors had already priced the cut into GoC bond yields in the lead up to the BoC’s meeting. By the time it materialized, it was old news.

Instead, the BoC’s more hawkish than expected policy-rate language became the next catalyst for bond yields, and that put some upward pressure on them in the immediate aftermath.

Variable-rate borrowers had to wait for the BoC’s rate cut to occur before they benefited. Their rates will now drop by an additional 0.25% in short order.

While the prospect of any additional BoC rate cuts now appears diminished, that can still change.

BoC Governor Macklem acknowledged the “considerable uncertainty” in the Bank’s forecasts, noting that “the range of possible outcomes is wider than usual, [and that] we need to be humble in our forecast”.

The pressures from our trade war and a weakening job market continue to build. For those reasons, I continue to expect at least one more 0.25% cut ahead.

As per my previous blogs, the BoC’s policy rate has bottomed out at 2% in each of the last five rate-cut cycles. (It now stands at 2.25%.)

Insider’s Tip for Borrowers

Does the payment frequency you choose have much impact on your mortgage?

The correct answer might surprise you.

This post separates the magic from the myth.

My Take on Today’s Most Popular Mortgage Options

My assessment of today’s mortgage options remains the same.

Fixed rates are offered at about their long-term average levels.

Right now, the best available three- and five-year fixed rates are both good options. If these rates remain roughly equal, I think five-year fixed-rate terms offer slightly better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full term.

That said, anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and in some cases, higher payments) should my assessment prove incorrect.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.