Why Canadian Inflation Will Probably Decline from Here

November 24, 2025

How Our Surprise Jobs Report is Impacting Mortgage Rates

December 8, 2025 Last week Statistics Canada confirmed that our GDP increased by 2.6% in Q3 on an annualized basis, marking a sharp bounce back from its 1.8% decline in Q2.

Last week Statistics Canada confirmed that our GDP increased by 2.6% in Q3 on an annualized basis, marking a sharp bounce back from its 1.8% decline in Q2.

That result was a lot better than the consensus forecast of 0.5%, but the bond market’s reaction was muted. A closer look at the more detailed data confirms why.

Most of our GDP increase in Q3 was attributed to an improvement in our net trade. We saw a sharp drop in imports (down 8.6% quarter-over-quarter) correspond with a small increase in exports (up 0.7% q/q). Stats Can chalked the decline in our imports up to a technicality, attributing it to the one-time impact of “the import of a large oil and gas platform module” in Q2 falling out of the calculation.

Stats Can also confirmed contractions in both final domestic demand (-0.1% q/q) and consumer spending (-0.4% q/q) in Q3. While capital investment increased overall, that rise was entirely attributed to more government capital investment. Business capital spending was flat, a result consistent with the low levels of business confidence confirmed in the Bank of Canada’s (BoC) latest Business Outlook Survey.

Finally, the hand off from Q3 to Q4 appears to have been weak. Stats Can’s initial flash estimate for our GDP growth in October was a 0.3% decline (month-over-month). That portends a slowdown ahead in Q4.

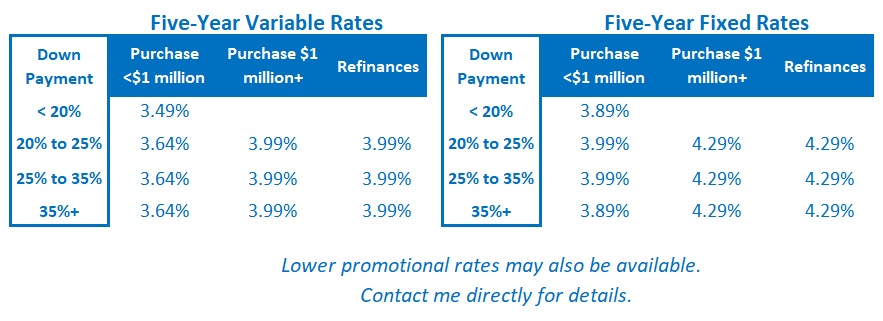

The Latest on Mortgage Rates

Government of Canada bond yields rose immediately after Stats Can released our latest GDP. That run up was short lived. The yields mostly finished the week a little lower than where they started.

Fixed mortgage rates held steady. The next major catalysts for movement may come from the next rounds of employment data being released in the US, on Wednesday, and in Canada, on Friday.

Variable-rate mortgage discounts off prime were unchanged last week.

I expect the BoC to enact at least one more 0.25% cut before its current rate-cut cycle is completed, but not imminently.

The Bank recently assessed that its policy rate is at “about the right level” based on its current projections. BoC Governor Macklem said that it would take an “accumulation” of evidence to cause the Bank to alter that assessment.

For that reason, I don’t expect the BoC to cut at its next meeting on December 10.

Insider’s Tip for Borrowers

Mortgage rates move in the same direction as bond yields over time.

Here are the two most important benchmark yields that anyone keeping an eye on mortgage rates should be monitoring:

- The 10-yr US Treasury yield: https://shorturl.at/P8deR

Simply put, the 10-yr US Treasury yield is the most influential single yield on the planet.

It can be thought of as the consensus forecast for the US economy distilled into one number. Both US mortgage rates and US corporate bond rates closely track its movements. Government bond yields in other countries are also influenced by its gravitational pull.

- The 5-yr Government of Canada bond yield: https://shorturl.at/1AVDL

The Canadian mortgage industry orbits around the five-year fixed-rate terms.

In addition to directly matching the most popular mortgage term, the 5-yr GoC bond yield serves as a proxy for the consensus forecast of the Bank of Canada’s extended policy-rate path. It distills medium-term economic expectations into one number, combining the outlooks for both the BoC’s monetary policy and longer-term inflation expectations.

If you want to know where Canadian mortgage rates are headed, the path of the 10-yr US Treasury yield and the 5-yr GoC bond yield are the best forward indicators.

My Take on Today’s Most Popular Mortgage Options

My assessment of today’s mortgage options remains the same.

Fixed rates are offered at about their long-term average levels.

Right now, the best available three- and five-year fixed rates are both good options. If these rates remain roughly equal, I think five-year fixed-rate terms offer slightly better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full terms (even though additional BoC rate cuts will likely be delayed).

Anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and in some cases, higher payments) should my assessment prove incorrect.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.