Canadian Inflation Cooled Where It Mattered Most in December

January 26, 2026 The Bank of Canada (BoC) held its policy rate steady last week, as expected.

The Bank of Canada (BoC) held its policy rate steady last week, as expected.

In its accompanying communications, the Bank held its cards tight to its chest.

It reiterated its previous assessment that its policy rate is now at about the right level based on its current economic projections and noted that our growth and inflation data had “not changed significantly” since its last policy-rate meeting in December.

As I predicted in my previous post, the BoC focused heavily on the negative impacts accruing from trade uncertainty centered around US President Trump’s erratic tariff announcements and the pending renegotiation of CUSMA this summer. BoC Governor Macklem also highlighted the risk that threats to the US Federal Reserve’s independence could roil global financial markets.

Of note, the Bank used the term uncertainty 22 times in its Monetary Policy Report, and Governor Macklem used it 7 times in his press conference Opening Statement.

Governor Macklem echoed the theme emphasized by Prime Minister Carney at Davos, repeatedly saying that “the days of open rules-based trade with the United States are over”.

He also emphasized that the Bank has limited ability to assist the sectors that are being hardest hit as justification for not making more near-term rate cuts.

While the BoC didn’t move its policy rate last week, it noted that “elevated uncertainty makes it difficult to predict the timing or direction of the next change in the policy rate” and reassured Canadians that it is willing to respond quickly if its outlook changes.

Given its emphasis on downside risks and the dovish tone of last week’s communications, if the BoC’s outlook does change, I think it is much more likely that it will be to the downside, with more cuts in tow.

The US Federal Reserve also held its policy rate steady on Wednesday.

It upgraded its assessment of the US economy and gave little hint that more rate cuts would be forthcoming (despite ongoing pressure from the US President).

Gregory Deco, Chief Economist at EY-Parthenon summed the situation up when he assessed that “while the Fed has been politically pressured to cut rates, it is not pressed by the data”.

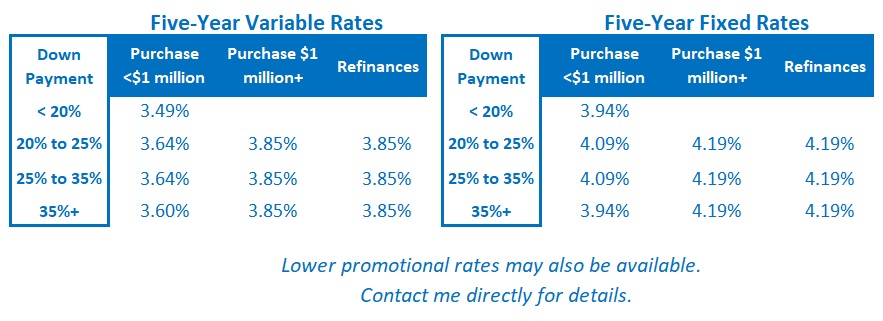

The Latest on Mortgage Rates

Global bond yields held steady last week despite new tariff threats from President Trump, another looming shutdown by the US Federal Government, and big swings in the US equities and commodities markets.

Canadian fixed mortgage rates remained range bound.

Our variable-rate discounts were also unchanged.

Bond-market investors now expect a longer pause by the BoC in 2026, and, surprisingly to me, they continue to bet that the Bank’s next move will be a hike.

For my part, I expect the BoC to cut by at least another 0.25% this year. I think the Bank clearly left that door open with its emphasis on responding quickly if its outlook changes.

Insider’s Tip for Borrowers

Did you know there is a way to make your mortgage interest tax deductible?

Spoiler alert: It requires plenty of patience or a lot of investment capital to pull off, but it can save eligible borrowers a substantial amount of money over time.

To learn more about how you can make this happen, check out my detailed posts: Part One, Part Two.

My Take on Today’s Mortgage Options

My advice is unchanged from last week.

Fixed rates are currently offered at about their long-term average levels, and three- and five-year fixed rates remain the most popular choices.

The premium that borrowers must pay to add additional years to their fixed-rate term has been increasing and will probably continue to do so. For now, I think five-year fixed-rate terms offer slightly better value.

I still expect today’s variable mortgage rates to produce the lowest borrowing cost over their full terms (despite my expectation that additional BoC rate cuts over the near term are not likely).

That said, anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and in some cases, higher payments) should my assessment prove incorrect.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.