No Move Last Week By an Increasingly Uncertain Bank of Canada

February 2, 2026 Last week Statistics Canada confirmed that our economy lost 25,000 jobs in January, well below the consensus forecast of +5,000.

Last week Statistics Canada confirmed that our economy lost 25,000 jobs in January, well below the consensus forecast of +5,000.

Our unemployment rate still managed to decrease from 6.8% to 6.5%, because 119,000 Canadians withdrew from the labour force (which meant they were no longer counted among the unemployed). That said, it remains elevated relative to our long-term average unemployment rate, which is about 6%.

Our employment mix improved slightly, with the loss of 70,000 part-time jobs being partially offset by a gain of 45,000 full-time jobs. Not surprisingly, most of the job losses were in Ontario (-67,000) with the manufacturing sector the hardest hit (-28,000).

Average hourly wage growth decreased slightly on an annualized basis, from 3.4% in December to 3.3% in January.

The latest employment data likely won’t have much impact on the Bank of Canada’s (BoC) overall assessment of our current economic conditions, which, according to its recent assessment, are evolving roughly as expected.

In a speech last week BoC Governor Macklem observed that US tariffs have forced our economy to undergo structural changes, particularly in our manufacturing sector.

He explained that while those structural changes “can bring benefits over time”, the transition, especially when it is “faster than we expect” could “be more painful than we’d like”.

Macklem then justified the BoC’s decision to hold its policy rate steady by highlighting its concern that “lowering interest rates in the face of weak economic activity risks stoking future inflation if the weakness is due to lower productive capacity rather than a cyclical downturn in demand”.

That’s where he lost me.

When COVID hit, our economy shuddered, not because of a change in demand, but because of a sharp drop in our economy’s productive capacity. Everything literally shut down.

Fearing depression-like conditions and with a mind toward skating where the puck was going, the BoC slashed its policy rate to the floor and enacted just about every form of stimulus it could conceive.

At that time, BoC Governor Poloz defended the Bank’s actions by saying that in times of crisis “a firefighter has never been criticized for using too much water”.

I’m not going to argue that the range of economic outcomes from US tariffs is now similar to the worst-case scenarios that seemed possible then, but there are similarities.

In both cases, economic weakness was tied to difficult-to-quantify structural changes. Strong economic headwinds were also abruptly apparent and expected to continue.

Then and now, monetary policy was limited in the offsetting stimulus it could provide, but during COVID the calculus was different.

The question I’d love to ask BoC Governor Macklem is “why?”

When the Bank starting to reduce its policy rate in June 2024, there was real concern that it would re-ignite speculative investment in our housing markets. But the Bank has since lowered its policy rate from 5% to 2.25%, and our largest housing markets are still in hibernation.

Those rate cuts haven’t caused demand in other rate-sensitive parts of our economy to spike either. For example, our retail sales have declined during seven of the last twelve months.

Average wage growth is still higher than our overall Consumer Price Index (3.3% vs 2.4%) but there should be little concern that our current level of wage growth will morph into a concerning source of inflation pressure any time soon. Economist David Rosenberg recently noted that there are now three unemployed Canadians for every job opening (and that is only counting those who are still actively seeking work).

Our key inflation gauges are now back with the BoC’s target range of 1% to 3%, and continued disinflation in shelter prices will help offset rising price pressures if they occur in other parts of our economy.

The BoC is forecasting stall-speed growth for our economy over the next three years, and yet our latest GDP data still managed to come in under that low bar.

I’m not calling for a return to a 0.25% policy rate. But if Governor Macklem believes that the Bank’s current policy rate of 2.25% is at the right level, he must also believe that monetary-policy stimulus isn’t required based on our current circumstances.

By the Bank’s own estimate, its policy rate is now at the lower end of its neutral range, which means it is neither restricting nor stimulating demand.

With all evidence pointing to additional economic slowing ahead and broad signs of cooling inflation, it seems obvious that more rate cuts should be forthcoming.

Surprisingly, at least to this blogger, instead of skating where the puck is clearly going, the BoC has decided to sit on the bench.

The Latest on Mortgage Rates

Government of Canada (GoC) bond yields remained range bound again last week.

The latest US employment data, for January, was delayed due to the US federal government shutdown. It will be released this Wednesday, and that will likely become the next catalyst for US Treasuries yields. Any significant reaction by US investors will likely take GOC bond yields along for the ride.

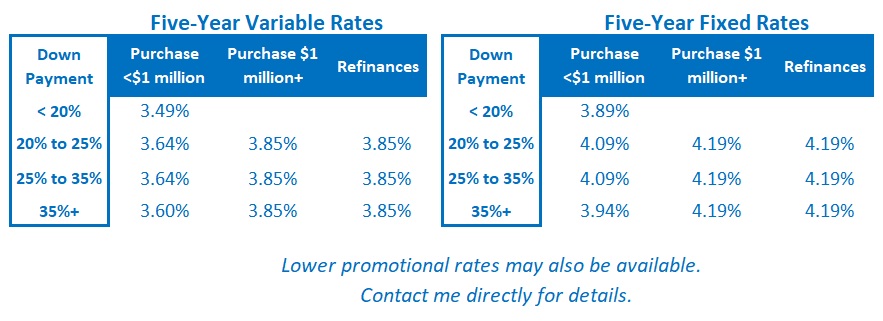

Relatedly, there were no changes in fixed mortgage rates last week.

Variable-rate mortgage discounts also held steady.

While bond-market investors continue to price in a hike by the BoC as its next move in late 2026, I still believe that more cuts are in store. Furthermore, I think the longer the Bank waits to reduce its policy rate to a stimulative level, the more it will then have to cut (to course correct).

My Take on Today’s Mortgage Options

Fixed rates are currently offered at about their long-term average levels, and three- and five-year fixed rates remain the most popular choices. For as long as the spread between those two options remains minimal, I think five-year fixed rates offer slightly better value.

I expect bond yields, and the fixed rates that are priced on them, to retain an upward bias over the near term. Borrowers who are actively looking to purchase a home are well advised to lock in a fixed-rate pre-approval to guard against that risk.

I still expect today’s variable mortgage rates to produce the lowest borrowing cost over their full five-year terms. My view is based in part on my belief that there are more BoC rate cuts in store this cycle. (Fair warning: this is a contrarian call. Bond market investors believe the Bank’s next eventual move will be a hike.)

Anyone choosing a variable rate should do so only if they are comfortable with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and in some cases, higher payments).

Insider’s Tip for Borrowers

If you are a first-time home buyer who is looking to purchase, here are my 13 guideposts to help you on that journey.

It provides a summary of my best advice after twenty-five years of working extensively with this buyer group.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.