My Take on the Bank of Canada’s Latest Forecasts

July 19, 2021Thoughts on Last Week’s US Federal Reserve Meeting

August 3, 2021 I was on vacation last week so today I will offer a recap of recent posts in case you missed them the first time around.

I was on vacation last week so today I will offer a recap of recent posts in case you missed them the first time around.

My Take on the Bank of Canada’s Latest Forecasts

This post provided highlights from the Bank of Canada’s latest policy statement and Monetary Policy Report.

Canadian Employment Surges, But Bond Yields Don’t

This post explains why our employment data surged in June, and why our bond market (uncharacteristically) shrugged at that news.

Why the US Employment Data Are Key for Canadian Mortgage Rates

This post provided highlights from the latest US employment report and explains why the US jobs data may impact Canadian mortgage rates more than our own over the near term.

How Will Canadian Mortgage Rates Be Impacted by the Fed’s New Rate-Hike Timetable?

This post provided highlights from the Fed’s most recent policy statement. I interpreted the Fed’s comments as being more dovish than the consensus initially assessed and predicted that the associated run-up in bond yields would be short lived (which proved correct).

Fixed or Variable? Let the Current Inflation Debate Be Your Guide

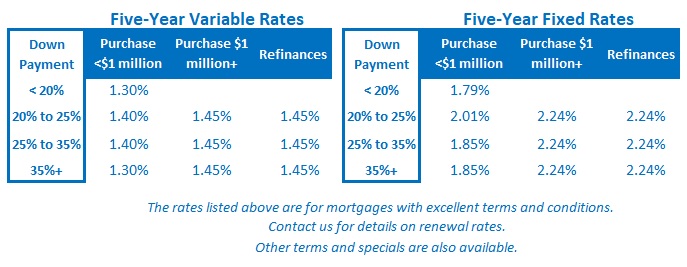

Finally, no highlight of recent posts would be complete without including my latest take on the mortgage question every borrower loves to ask: Will I save more with a fixed or variable rate over the next five years? The Bottom Line: Fixed and variable rates held steady last week.

The Bottom Line: Fixed and variable rates held steady last week.

That said, there was a noteworthy plunge in the Government of Canada five-year bond yield that our five-year fixed mortgage rates are priced on, from around 1.00% down to .80%.

If it holds at that level, we may soon see a small reduction in the five-year fixed rates offered by the most competitively priced lenders.

1 Comment

This is a very researched an informative content. Great work!