Was That the Bank of Canada’s Last Rate Cut?

November 3, 2025

Rate Cut Odds Are Being Significantly Pared Back

November 17, 2025 Last Friday Statistics Canada confirmed that our economy added 67,000 new jobs in October, defying the consensus estimate that 5,000 jobs would be lost instead.

Last Friday Statistics Canada confirmed that our economy added 67,000 new jobs in October, defying the consensus estimate that 5,000 jobs would be lost instead.

This was the second month in a row that the headline print came in much higher than expected. Our economy added 60,000 jobs in September. That result was also well above the consensus estimate of a modest gain of 5,000 new jobs.

Of note, last month’s job growth came from the private sector (+73,000), average wage growth increased from 3.3% in September to 3.5% in October, and our unemployment rate declined from 7.1% to 6.9%.

Despite those encouraging signs, Bank of Canada (BoC) Governor Macklem’s recent assessment that our labour market is soft is still apt.

Most of the newly created jobs were in part-time positions, our unemployment rate is still 0.3% above where it started the year, and our average wage growth has slowed over that same period.

Our stronger-than-expected employment data are encouraging signs of our economy’s resilience, but they are not warnings that our economy’s supply of labour will outstrip the demand for it any time soon.

The Latest on Mortgage Rates

Government of Canada bond yields were range bound throughout most of last week before spiking higher on Friday after our latest employment data were released.

That said, the move wasn’t enough to put significant upward pressure on our fixed-rate mortgages. They remained largely unchanged last week.

When the BoC cut its policy rate to 2.25% on October 29, it assessed that to be “about the right level” based on its current projections and said that it would take an “accumulation” of evidence before it would alter that assessment.

I don’t think last week’s employment data will impact the Bank’s plans either way over the long run. But I do now expect it to hold steady into Q1 next year, based on its most recent guidance.

Beyond that, I think difficult economic conditions will compel the BoC to reduce its policy rate to a lower stimulative level before its current rate-cut cycle is complete. (By the Bank’s own estimate, its policy rate won’t be considered stimulative until it is reduced to at least 2%.)

Insider’s Tip for Borrowers

Non-bank lenders can offer very competitive rates, and the terms and conditions in their mortgage contracts are often the most consumer friendly.

Borrowers who are considering non-bank mortgage options often wonder (and worry) what will happen if their lender goes bust.

I wrote this post back when Home Capital Group’s (HCG) shares plunged by 65% after the Ontario Securities Commission (OSC) alleged that the company had engaged in widespread mortgage fraud.

Amid the market’s panic, I predicted that HCG wouldn’t go under, I explained how well regulated the Canadian lender market was (as it is now), and I pushed back hard against the mainstream media’s hot take that this might be Canada’s Lehman moment.

That post has aged well, and its key message still rings true: Canada’s non-bank regulated mortgage lenders are rock solid, even without a branch on every corner.

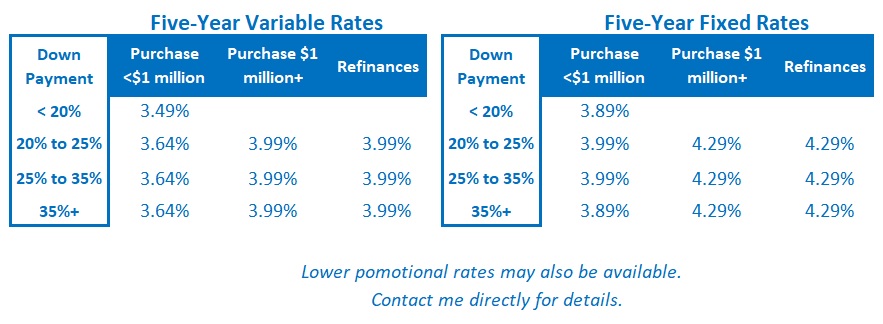

My Take on Today’s Most Popular Mortgage Options

My assessment of today’s mortgage options remains the same.

Fixed rates are offered at about their long-term average levels.

Right now, the best available three- and five-year fixed rates are both good options. If these rates remain roughly equal, I think five-year fixed-rate terms offer slightly better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full terms (even though additional BoC rate cuts will likely be delayed).

That said, anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and in some cases, higher payments) should my assessment prove incorrect.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.