Mortgage Rates Set to Fall After the Fed’s Dovish Shift

October 20, 2025

Was That the Bank of Canada’s Last Rate Cut?

November 3, 2025 There is broad consensus that the Bank of Canada (BoC) will cut its policy rate by another 0.25% when it meets this week. That belief is underpinned by several factors:

There is broad consensus that the Bank of Canada (BoC) will cut its policy rate by another 0.25% when it meets this week. That belief is underpinned by several factors:

Dovish policy-rate language – At the BoC’s last meeting on September 17, its rate cut was accompanied by dovish guidance. The Bank assessed that our economy was slowing and that there was less risk of higher inflation.

Shifting emphasis away from core inflation (which is higher) – In a speech made two weeks later, BoC Deputy Governor Rhys Mendes downplayed the importance of the Bank’s core inflation gauges, which are hovering in the 3% range. He said that the Bank uses a wide range of indicators and that it estimates our current overall inflation rate at closer to 2.5%. Less inflation pressure gives the BoC more room for additional cuts.

Downplaying stronger-than-expected employment data – BoC Governor Tiff Macklem recently downplayed our surprisingly strong September employment report. He cautioned against over-reacting to one strong report, and he assessed our current labour market conditions as “soft”.

The Bank’s downbeat consumer and business outlook surveys – Last week the Bank released its business and consumer survey data for Q3. As per economist David Rosenberg, the survey results confirmed that one-third of businesses are now planning for a recession while fully two-thirds of households are prepping for one.

The Latest on Mortgage Rates

The Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, were range bound last week. Nonetheless, some lenders reduced their fixed rates in response to the drop in yields the week before.

Variable-rate mortgage discounts were unchanged.

Bond-market investors now put the odds of a 0.25% rate cut by the BoC at approximately 85%.

Quick recap: The BoC’s policy rate currently stands at 2.5%. By the Bank’s own estimate, its policy rate won’t start to stimulate demand until it is reduced to at least 2%.

My take: The BoC has reduced its policy rate to that level, or lower, during each of its five most recent rate-cut cycles. I think the Bank will cut this Wednesday, and I expect it to cut at least one more time thereafter before ending its current rate-cut cycle.

Insider’s Tip for Borrowers

This post offers mortgage advice to homeowners who are trying to work through a divorce.

It outlines some key steps that must be taken prior to removing a spouse from title and/or completing a refinance to buy them out. It also includes several other useful tips, which I have accumulated over many years of helping borrowers navigate a marital split.

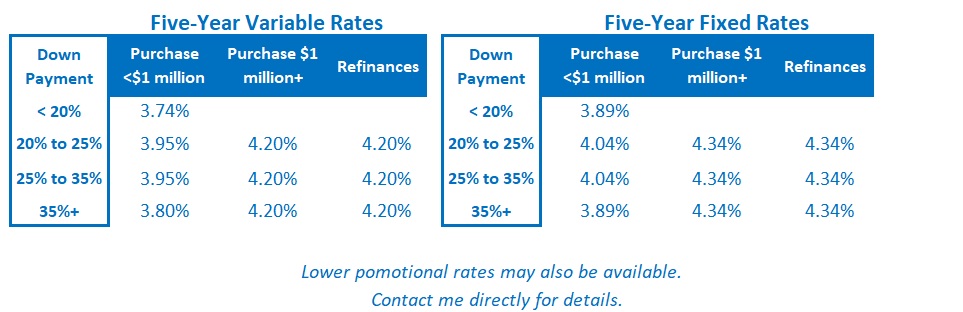

My Take on Today’s Most Popular Mortgage Options

My assessment of today’s mortgage options remains the same.

Fixed rates are offered at about their long-term average levels.

Right now, the best available three- and five-year fixed rates are both good options. If these rates remain roughly equal, I think five-year fixed-rate terms offer slightly better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full term (thanks, in part, to more BoC rate cuts over the near term).

Anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and in some cases, higher payments) should my forecast prove incorrect.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.