Monday Morning Interest Rate Update – How Job Losses Are Impacting our Mortgage Rates

August 11, 2025

Cooling Inflation Opens the Door for BoC Rate Cuts Ahead

August 25, 2025 Bond-market investors are now pricing in about a 95% chance that the US Federal Reserve will cut its policy rate at its next meeting on September 17.

Bond-market investors are now pricing in about a 95% chance that the US Federal Reserve will cut its policy rate at its next meeting on September 17.

That view was bolstered in part by the release of the latest US inflation data, which showed that the US Consumer Price Index (CPI) remained at 2.7% in July on a year-over-year basis. Investors were relieved that US President Trump’s tariffs hadn’t pushed prices higher overall.

But a closer look at the data should give them cause for concern. For example, US core inflation, which strips out volatile food and energy prices, increased from 2.9% in June to 3.1% in July.

Most of that increase was attributed to higher prices for services, which aren’t affected by tariffs. But tariffs do impact the prices of imported goods, and last week we received a warning that those prices will soon be spiking higher.

On Thursday, we received the latest US Producer Price Index (PPI), which measures the prices that wholesalers pay for the goods that they then sell to consumers. It increased by 0.9% in July on a month-over-month basis, tripling the consensus estimate. It increased from 2.4% in June to 3.3% in July on a year-over-year basis.

The impact of tariffs on US prices had been delayed by businesses working through their pre-tariff inventories, but last month’s PPI confirmed that those buffers have now considerably diminished.

US core inflation was primarily driven by service prices last month, but the latest US PPI is a warning that goods prices will also be exerting more upward pressure on US inflation in the near future.

Now let’s turn back to the expected Fed rate cut.

If the Fed decides to cut its policy rate even as US inflation marches higher, bond-market investors will almost certainly respond by pushing up longer-term US bond yields. If that happens, we should expect our Government of Canada (GoC) bond yields, and the fixed mortgage rates that are priced on them, to be taken along for the ride.

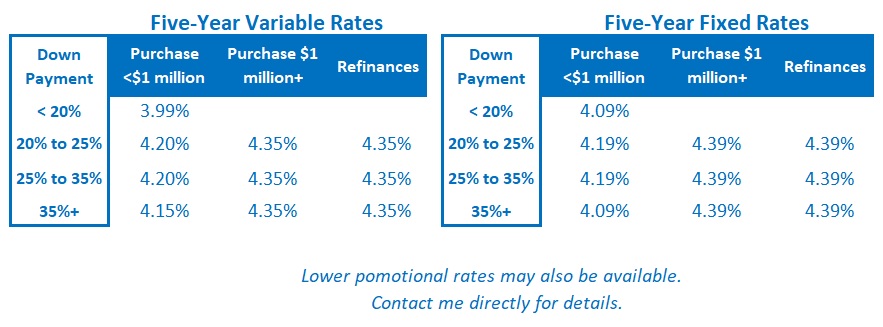

The Latest on Mortgage Rates

GoC bond yields followed their US Treasury equivalents higher at the end of last week as bond-market investors priced in the latest US PPI print, which came in much higher than expected.

I expect GoC bond yields, as well as our fixed mortgage rates, to retain their upward bias over the near term.

Variable-rate discounts were unchanged last week.

Bond-market investors currently put the odds of a Bank of Canada rate cut at its next meeting at 35%. Those odds will increase if our current run of lackluster economic data continues.

Statistics Canada will release our latest CPI data, for July, this Tuesday. I’ll offer my take on that report next week.

Insider’s Tip for Borrowers

Did you know there is a way to make your mortgage interest tax deductible?

Spoiler alert: It requires plenty of patience or a lot of investment capital to pull off, but it can save eligible borrowers a substantial amount of money over time.

To learn more about how you can make this happen, check out my detailed posts: Part One, Part Two.

Mortgage Selection Advice

My mortgage selection advice this week is repeated from last week.

Fixed rates are now near their long-term averages. The term premium, which is the additional cost that borrowers must pay to lock in for longer terms, is slowly being restored as our bond-yield curve continues to normalize.

Right now, the best available three- and five-year fixed rates are roughly equal. As long as that remains the case, I think five-year fixed rates offer slightly better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full term, even now that the consensus believes additional BoC rate cuts will take longer than expected.

Anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and, in some cases, higher payments) should my forecast prove incorrect.

Three Posts I Think Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.