Monday Morning Mortgage Rate Update – New and Improved Format

June 23, 2025

How Will Delayed US Rate Cuts Impact Canadian Mortgage Rates?

July 7, 2025 Quick Summary: Last week Statistics Canada confirmed that our key measures of core inflation cooled a little in May and our GDP decreased by 0.1% in April (month-over-month). Stats Can also now estimates that our GDP declined by the same amount in May.

Quick Summary: Last week Statistics Canada confirmed that our key measures of core inflation cooled a little in May and our GDP decreased by 0.1% in April (month-over-month). Stats Can also now estimates that our GDP declined by the same amount in May.

Mortgage Advice for Now

My advice is unchanged from last week.

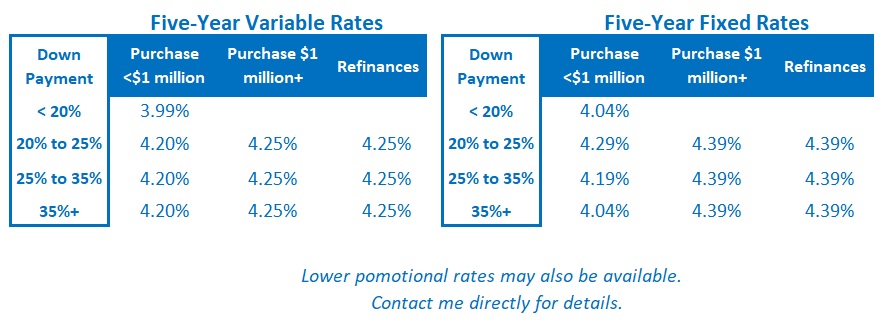

Fixed rates are now back below their long-term averages. The rate premium that borrowers have historically had to pay for longer terms is slowly being restored.

For now, today’s best available three- and five-year fixed rates are roughly equal. For as long as that remains the case,

I think five-year fixed rates offer better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full term. But these are volatile times. Anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility and if they have the financial capacity to withstand higher payments should my forecast prove incorrect.

If you are interested in a more detailed explanation of the rationale behind my current mortgage-selection advice, check out this post. The Bottom Line

The Bottom Line

Government of Canada bond yields dropped a little last week but not by nearly the extent that we would normally see when there is heightened geopolitical uncertainty. Although other assets, such as oil and gold, haven’t reacted in their typical way, there seems to be a floor forming under bond yields at their current levels.

Fixed mortgage rates were unchanged last week and should stay range bound in what will be a short week ahead, as both Canada and the US celebrate their independence days.

Bond-market investors continue to expect the Bank of Canada (BoC) to enact two more 0.25% rate cuts over the remainder of 2025, although they are not currently expecting a cut at the Bank’s next meeting on July 30.

Cooling inflation will give the BoC leeway to enact more cuts.

The slow and steady deterioration of our economic data (GDP, employment, retail sales) supports my view that a lower stimulative policy rate will ultimately be needed.

As reminder, the Bank’s policy rate now stands at 2.75%, which is considered the mid-point of its neutral-rate range. It won’t be at a stimulative level until it is reduced to 2.00%. Not coincidentally, the BoC has reduced its policy rate to 2.00%, or lower, during its last five rate-cut cycles stretching back more than twenty-five years.

Three Posts That I Think Every Canadian Mortgage Borrower Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.