How Will Delayed US Rate Cuts Impact Canadian Mortgage Rates?

July 7, 2025

Monday Morning Mortgage Rate Update – Inflation on the Brain

July 21, 2025 Highlights From Last Week

Highlights From Last Week

US economic data continue to hold up, despite the ongoing uncertainty about tariff impacts and US President Trump’s next moves.

While a crisis has thus far been avoided, I thought this quote from a recent Economist article summed the situation up well: “America’s economy is dodging disaster but storing up trouble.”

The Canadian economy added an estimated 83,100 new jobs in June, well above the consensus forecast. Despite the banner headline, a full 70,000 of those new jobs were part-time. Average hourly wage growth slowed 3.2% year-over-year, so wage pressures continued to ease last month.

The Latest on Mortgage Rates

Government of Canada (GoC) bond yields increased last week. They were pulled higher by rising US Treasury yields and by our stronger-than-expected employment report.

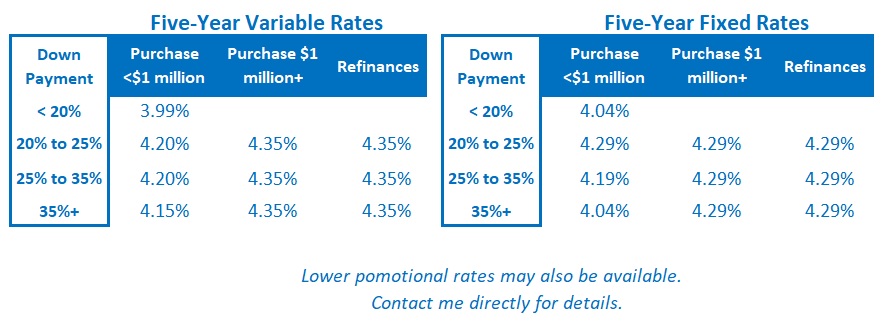

Some lenders responded by increasing their fixed mortgage rates on Friday and I expect others to follow. Those increases are consistent with my recent assessment that bond yields, and the fixed mortgage rates that are priced on them, now have an upward bias.

I don’t think the latest employment data will have much impact on the Bank of Canada’s near-term policy-rate plans. But our latest inflation data, due out tomorrow, most certainly will. Stay tuned.

Mortgage Selection Advice

My mortgage selection advice remains unchanged from last week.

Fixed rates are back below their long-term averages. The term premium, which is the additional cost that borrowers have to pay to lock in for longer, is slowly being restored.

For now, today’s best available three- and five-year fixed rates are roughly equal. For as long as that remains the case, I think five-year fixed rates offer better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full term. But these are volatile times. Anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility and if they have the financial capacity to withstand higher costs (and, in some cases, higher payments) should my forecast prove incorrect.

If you are interested in a more detailed explanation of the rationale behind my current advice, check out this post.

Insider’s Tip for Borrowers

Many of the borrowers I work with are surprised to learn that there are two types of variable-rate mortgages.

The first type comes with an adjustable payment, which changes up or down with each rate movement.

The second type comes with a fixed payment. When the rate changes, the amortization period adjusts. That means the portion of each payment that goes toward principal and interest changes instead of the payment.

(Note: If your rate rises to a level where your fixed payment no longer covers the interest cost, your monthly payment must then be reset higher. But that typically wouldn’t happen until the rate increases by about 2%.)

Three Posts I Think Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.