Monday Morning Mortgage Rate Update – Inflation on the Brain

July 21, 2025

Monday Morning Interest Rate Update – No Rate Cuts Yet, But Plenty of Action

August 5, 2025 Highlights From Last Week

Highlights From Last Week

There were no significant economic data releases last week, so most of the market’s attention focused on US President Trump’s threat to hit Canada with a 35% tariff this Friday (Aug 1) unless a trade deal is reached.

A deal isn’t close, so the higher tariff rate will likely kick in, but it will only impact exports which aren’t covered under CUSMA (about 20% of our total US exports.)

The Latest on Mortgage Rates

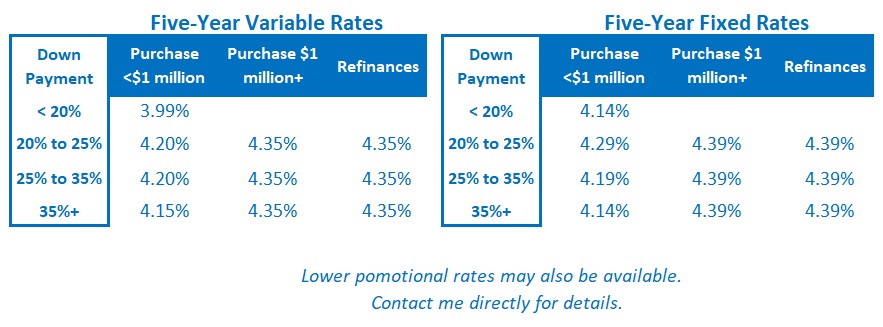

Bond yields were range bound last week, and the fixed mortgage rates that are priced on them also held mostly steady. But both retain some upward bias for the time being.

The Bank of Canada (BoC) meets this Wednesday and there is broad consensus that it will again hold its policy rate steady. Our key core inflation measures are still hovering in the 3% range, which is too high for the Bank’s liking.

I expect no move by the BoC at this week’s meeting. For now, our economic data are proving resilient, and our inflation is running too hot. But the negative economic impacts from the US trade-war will intensify, and I expect the BoC to eventually cut its policy rate in response.

Insider’s Tip for Borrowers

Pre-approvals are not promises to lend you money. In fact, despite their names, they often aren’t worth the paper they are written on from a credit standpoint.

Getting pre-approved is still often a good idea.

It locks in a rate that may come in handy later. If the person who is taking your application is knowledgeable, they can give you an estimate of your maximum mortgage amount based on your income. But applying for a mortgage always includes some risk that a pre-approval won’t protect you from.

A detailed understanding of how pre-approvals work will ensure that you don’t get lulled into a false sense of security.

To learn more, check out this post.

Mortgage Selection Advice

Fixed rates remain a little below their long-term averages, but the term premium, which is the additional cost that borrowers must pay to lock in for longer, is slowly increasing.

Right now, the best available three- and five-year fixed rates are roughly equal. As long as that remains the case, I think five-year fixed rates offer better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full term, even now that additional BoC rate cuts are taking longer than expected.

Anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and, in some cases, higher payments) should my forecast prove incorrect.

Three Posts I Think Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.