Why the Bank of Canada Will Probably Regret Not Cutting Last Week

June 9, 2025

Monday Morning Mortgage Rate Update – New and Improved Format

June 23, 2025 When I offer a view on where mortgage rates may be headed, it is only after carefully weighing the question: What if I’m wrong?

When I offer a view on where mortgage rates may be headed, it is only after carefully weighing the question: What if I’m wrong?

The contrarian in me is constantly reminded of the wise and well-worn adage that when all the forecasters agree, something else is going to happen.

In today’s post, I will play devil’s advocate and highlight the factors that may cause rates to follow a different path than the consensus expects.

Most of the borrowers I speak with these days expect our mortgage rates to drop in the near future, based primarily on the belief that US tariffs will trigger an economic slowdown.

Normally when our economy slows, demand weakens, inflation cools, and Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, decrease in response.

But the reaction of bond-market investors to last week’s news served as a warning that things may not play out as expected this time.

For example, last Tuesday we received the latest US inflation data, which was a little softer than forecast. US Treasury yields did fall immediately, but only by a little, and by midday Friday, they had recovered to their pre-announcement levels (with GoC bond yields following in near lockstep, as usual).

Bond-market investors expect US President Trump’s tariffs to put upward pressure on US prices soon, and that expectation muted their reaction to the latest US inflation print.

Then, at midday on Friday the world learned that Isreal had launched strikes against Iran.

Normally, geopolitical instability causes a surge in demand for safe-haven assets, with US Treasuries and GoC bonds chief among them. But this time, they barely budged, and that may be a sign that there is a floor firming up under sovereign bond yields at or near their current levels.

Concerns about rising inflation aren’t tied just to tariffs.

US and Canadian federal governments are planning substantial spending increases, which will significantly increase their budget deficits and stoke inflationary pressures.

Interestingly, bond-market investors still expect both the US Federal Reserve and the Bank of Canada (BoC) to cut their policy rates further this year in response to near-term economic weakness.

But only our variable mortgage rates will benefit directly from those cuts. And if the hotter inflation that bond-market investors increasingly fear materializes, those policy rate cuts may not happen in 2025.

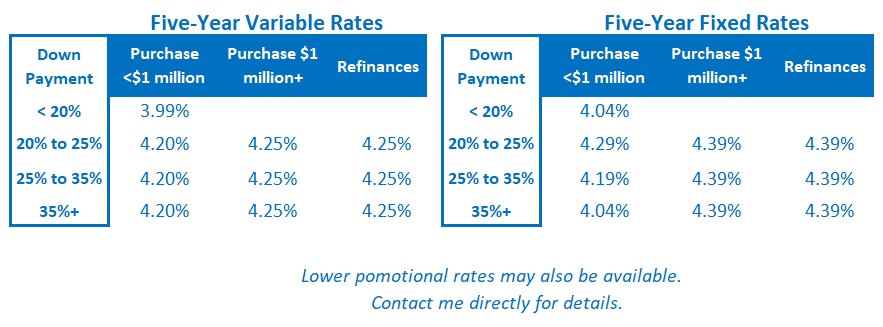

Reminder to self: Forecasts should always be written with a pencil, not with a pen.  The Bottom Line: Five-year GoC bond yields increased a little last week and, as per the points made above, I think bond-market investors have an upward bias for yields, which is increasingly apparent.

The Bottom Line: Five-year GoC bond yields increased a little last week and, as per the points made above, I think bond-market investors have an upward bias for yields, which is increasingly apparent.

While that dynamic isn’t putting immediate pressure on our fixed mortgage rates, it does lead me to believe that fixed rates are more likely to rise than fall over the near term.

Aggressive fiscal spending plans may have even more lasting impact on inflation than tariffs, and both the BoC and the Fed are no doubt taking note of the pledges being made.

If all (or most) of the promised spending materializes, inflation may prevent the BoC and the Fed from making the policy-rate cuts that have long been expected … and still are … at least for the time being.