The Bank of Canada Tightens Again

July 17, 2023Monday Morning Interest Rate Update

July 31, 2023 Last week Statistics Canada confirmed that our Consumer Price Index (CPI) dropped to 2.8% in June, its lowest level in more than two years.

Last week Statistics Canada confirmed that our Consumer Price Index (CPI) dropped to 2.8% in June, its lowest level in more than two years.

Anyone keeping an eye on Canadian mortgage rates may have been surprised when the Government of Canada (GoC) bond yields barely reacted.

That’s likely because there are some compelling data to support the belief that inflation is headed higher in the months ahead.

To understand why inflation has almost certainly bottomed over the near term, we need to take a more detailed look at the significant disinflationary impact that base effects have had on our recent CPI data.

Let’s start with a quick review of Stats Can’s definition of base effects:

A base-year effect refers to the impact that price movements from 12 months earlier have on the current month’s headline consumer inflation. When a large 1-month upward price change in the base month stops influencing or falls out of the 12-month price movement, this has a downward effect on headline CPI in the current month.

Until now, most of the drop in our CPI from its peak of 8.1% down to its new low of 2.8% last month has been caused by higher price-change months rolling out of the back end of the CPI data set. This base-effect tailwind has made our current inflation look milder than it really is. But that is about to change.

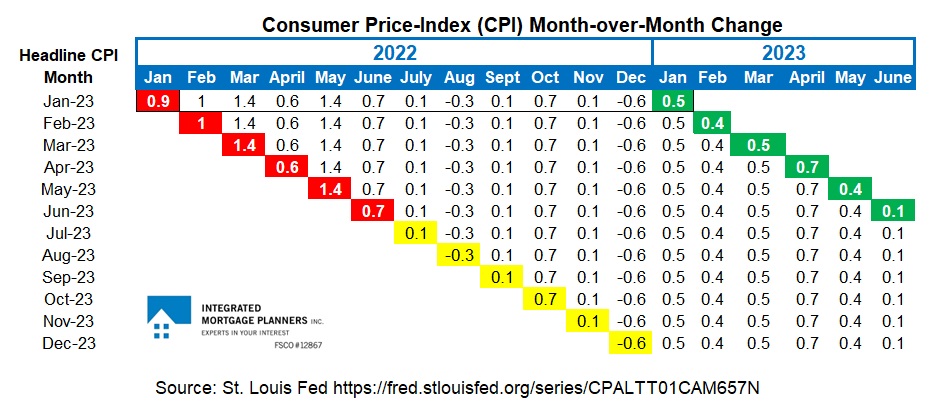

Here is a table that summarizes the monthly CPI data (rounded) that were used to calculate our headline CPI results thus far in 2023.The first line in the table above shows that our CPI rose by 0.9% in January 2022 on a month-over-month basis (see number highlighted in red), and our CPI increased by 0.5% month-over-month in January 2023 (see number highlighted in green).

When Stats Can added the January 2023 month-over-month result to our CPI data set (+0.5%), it also removed the January 2022 month-over-month result (+0.9%). The net result was that our headline CPI dropped to 5.9% in January 2023. While that was a decrease from the month prior, it still left our CPI at a multiple of the BoC’s 2% target.

Let’s now compare the six monthly readings that have been dropped from our headline CPI data set thus far in 2023 (highlighted in red) to the new monthly readings that were added in their place (highlighted in green).

The six monthly readings that were dropped averaged +1.0%. The six new monthly readings that were added averaged +0.43%. That means base effects have reduced our CPI by an average of 0.57% over the past six months.

Next, let’s look at the numbers that will fall out of our headline CPI data set over the next six months (see numbers highlighted in yellow). They average out to +0.02%. For the base effect to have the same dampening impact on our CPI over next six months that it had over the previous six months, our monthly CPI readings will need to average -0.55%. (Spoiler alert: That’s not happening.)

This is a big reason why BoC Governor Macklem recently noted that “the downward momentum of inflation is waning” and why he warned that “the progress toward price stability could stall”.

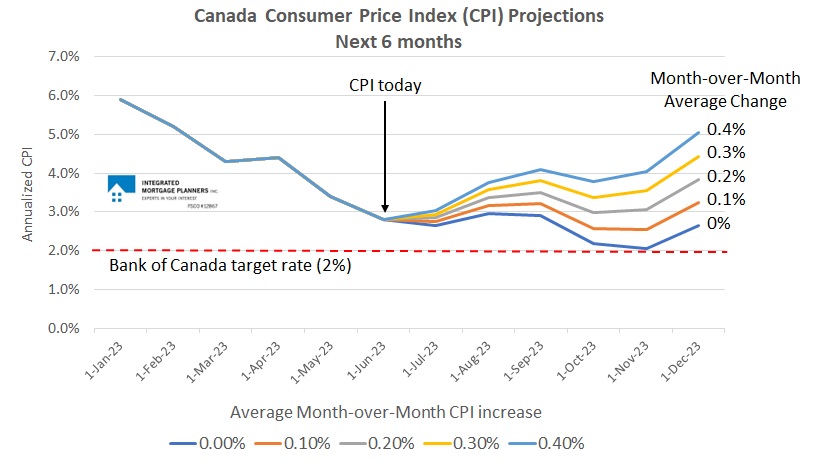

Now let’s try to estimate a range that our headline CPI may be headed toward over the remainder of the year.

The graph below shows what will happen to our headline CPI if we average monthly readings of 0.0%, +0.1%, +0.2%, +0.3% and +0.4% for the next six months. In four out of the five scenarios, inflation finishes the year above its current level of 2.8% and, in three of the five scenarios, significantly so.

In four out of the five scenarios, inflation finishes the year above its current level of 2.8% and, in three of the five scenarios, significantly so.

The next question to ask is, are these assumptions about CPI readings over the next six months reasonable?

Consider the following:

- Our average monthly reading thus far in 2023 has been 0.43% (which, if it continued, would push inflation a little above the light blue line in the chart above).

- Shorter-term three-month measures of core inflation, which strip out volatile food and energy prices, have increased by between 3.5% and 4% (year-over-year) since last September. That works out to an average month-over-month increase of about 0.3%.

- Right now, as per the BoC, “over half of the components in the consumer price index (CPI) basket are rising above 5%” year-over-year.

- Labour costs are the single largest expense for most businesses, and average wages have risen within a range of 4% to 5% (annualized) thus far in 2023.

- Canadian businesses are still planning to increase prices “more frequently than they did prior to the pandemic” (via the BoC’s most recent Business Outlook Survey). The BoC now estimates that “previously unforeseen strength in house prices is likely to persist and boost inflation by as much as 0.3 percentage points [annualized] by the end of 2023”.

I hope the explanation above helps clarify why the BoC hiked its policy rate by another 0.50% this summer and why the near-term trajectory of our headline CPI may compel them to continue doing so.

Inflation is going to bounce.

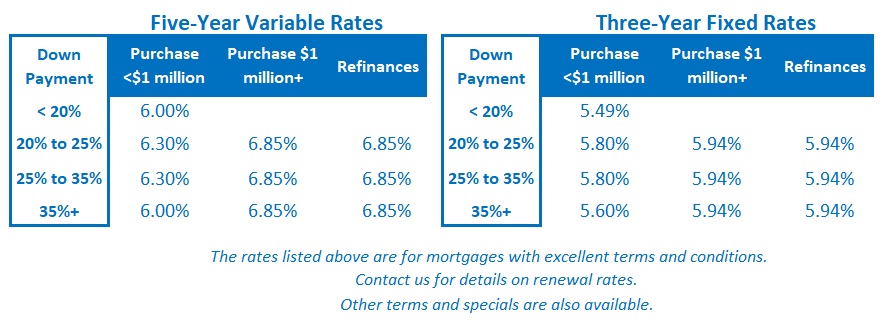

Forewarned is forearmed. The Bottom Line: GoC bond yields were range bound last week, but lenders continued to raise their fixed mortgage rates.

The Bottom Line: GoC bond yields were range bound last week, but lenders continued to raise their fixed mortgage rates.

The US Federal Reserve will issue its next policy-rate decision this week, and I expect that it will follow in the BoC’s footsteps and offer a more-hawkish-than-expected rate view. If that happens, US bond yields will rise and GoC bond yields will be taken along for the ride.

Variable-rate mortgage discounts were unchanged last week. While I hope that variable-rate borrowers won’t have to endure any further rate increases, for the reasons outlined above, I think the near-term path of inflation could compel the BoC to hike once again.