Rate Cut Odds Are Being Significantly Pared Back

November 17, 2025

Why Our Stronger-than-Expected GDP Data Didn’t Impact Bond Yields

December 1, 2025 Last week Statistics Canada confirmed that our Consumer Price Index (CPI) decreased from 2.4% in September to 2.2% in October on a year-over-year (YoY) basis, which was in line with consensus expectations.

Last week Statistics Canada confirmed that our Consumer Price Index (CPI) decreased from 2.4% in September to 2.2% in October on a year-over-year (YoY) basis, which was in line with consensus expectations.

The Bank of Canada’s various measures of core inflation were a mixed bag – with some moving up and others moving down. All told, the latest inflation data probably won’t materially alter the Bank’s assessment of our overall inflation pressure.

The biggest surprise was the jump in average rents, which spiked higher by 1.0% month-over-month and increased from 4.8% in September to 5.2% in October YoY.

Rising average rent prices don’t jibe with abundant anecdotes of landlords reducing their asking prices in major markets across the country, and softening demand makes sense alongside a sharp reduction in new immigrants. For that reason, while rents did add to inflation pressure last month, real-time feedback implies that it won’t take long for that pressure to ease.

The BoC wasn’t expected to cut its policy rate at its next meeting on December 10, and I don’t think the latest inflation data will materially alter its plans. But there is good reason to expect Canadian inflation to decline further in the months ahead.

Shelter costs have been the most consistent driver of inflation pressure since the pandemic, and they have the largest weighting in our CPI basket (at 30% of the total).

If rental demand continues to weaken, as I expect, rent-price growth will slow.

Additionally, mortgage rates are down considerably from their peaks. There is a long lag before those declines help to reduce our CPI, due to the way average mortgage rates are calculated. But the future deflationary impact from falling interest rates is already baked in (unless they suddenly spike a lot higher, which seems unlikely).

If decelerating shelter prices help reduce inflation pressure, that will give the BoC the flexibility it needs to enact further rate cuts if warranted by overall economic conditions.

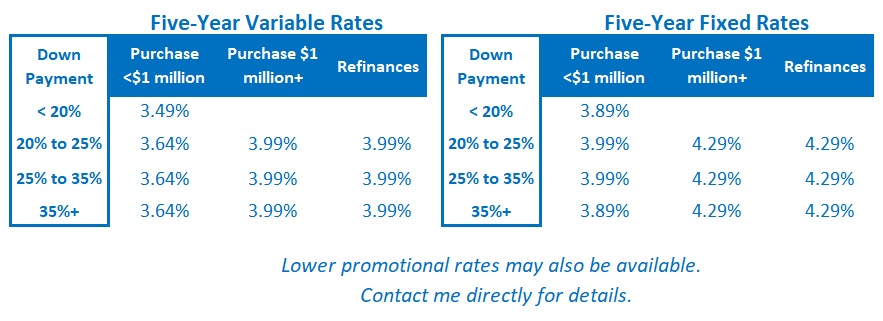

The Latest on Mortgage Rates

Government of Canada (GoC) bond yields were range bound last week.

There was little reaction to the release of our latest CPI data, and most of last week’s movement in yields was tied to US Treasury yield fluctuations. Bond-market investors south of the border are adjusting their bets on a Fed rate cut at its next meeting on December 10 in response to speeches made by some of the Fed’s voting members (and there have been plenty of them recently).

All told, there is currently no significant pressure on our fixed mortgage rates, in either direction.

Variable-rate mortgage discounts off prime were unchanged last week.

I expect the BoC to enact at least one more 0.25% cut before its current rate-cut cycle is completed, but not imminently.

The Bank recently assessed that its policy rate is at “about the right level” based on its current projections. BoC Governor Macklem said that it would take an “accumulation” of evidence to cause the Bank to alter that assessment.

For that reason, I don’t expect the BoC to cut again until the new year.

Insider’s Tip for Borrowers

By rule, the interest rates offered on fixed-rate mortgages must be compounded semi-annually.

But lenders can compound their variable mortgage rates either semi-annually or monthly, and one of those methods is cheaper than the other.

To learn more, check out this post.

My Take on Today’s Most Popular Mortgage Options

My assessment of today’s mortgage options remains the same.

Fixed rates are offered at about their long-term average levels.

Right now, the best available three- and five-year fixed rates are both good options. If these rates remain roughly equal, I think five-year fixed-rate terms offer slightly better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full terms (even though additional BoC rate cuts will likely be delayed).

Anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and in some cases, higher payments) should my assessment prove incorrect.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.