Weak US and Canadian Employment Reports Fuel Rate-Cut Speculation

September 8, 2025

A Rate Cut Bonanza

September 22, 2025 Highlights from Last Week

Highlights from Last Week

Last week’s most noteworthy mortgage-rate related developments came from US data releases.

To recap, the US Federal Reserve (Fed) must adhere to a dual mandate when administering its monetary policy: 1) maintain low and stable inflation and 2) promote maximum employment.

That is noteworthy because right now those two objectives are in conflict.

Last Tuesday we learned that the US Consumer Price Index (CPI) increased from 2.7% in July to 2.9% in August. It accelerated further at the margin, increasing by 0.4% month-over-month.

US core inflation, which strips out volatile food and energy prices, came in at 3.1% year-over-year in August. Core prices are also accelerating at the margin, rising 0.3% in August month-over-month.

These inflation results were well above the Fed’s 2% target level. The persistence of above target inflation, especially when it corresponds with profligate fiscal spending, calls for tighter monetary policy.

But …

Last Tuesday, the Bureau of Labour Statistics (BLS) sharply reduced its estimates of new-job creation in the twelve months through March 2025 by 911,000 jobs. That is on top of the 247,000 reduction it recently made to its employment estimates from April to August 2025.

These massive revisions, which are the steepest since the current reporting began in 2000, confirm that US employment is not nearly as strong as was previously believed. The average monthly US jobs print over the past year has now been slashed by more than 50%.

When the Fed meets this Wednesday, it must weigh the need to support the struggling labour market alongside the risk that a rate cut will stoke inflation that is already running too hot.

The market thinks the Fed will cut. Bond-market investors have priced in a 100% probability of that occurring.

For now, that has caused longer-term US Treasury yields to fall, and their gravitational pull has taken Government of Canada (GoC) bond yields lower as well.

But US bond-market investors have been jittery of late. If US inflation doesn’t cool soon, I believe it is reasonable to assume that those longer-term bond yields, and the fixed rates that are priced on them, will resume their upward march.

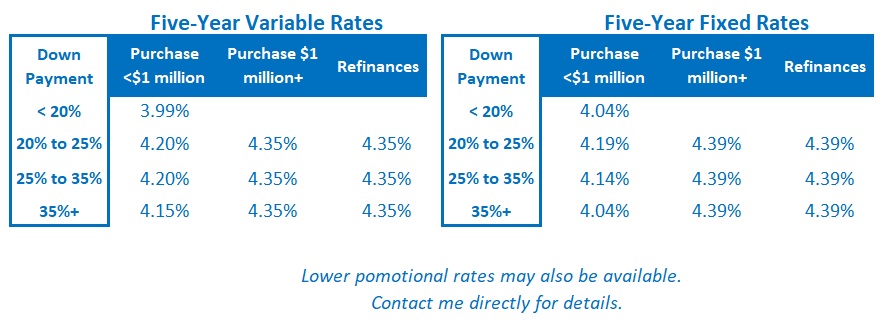

The Latest on Mortgage Rates

Fixed Rates

Government of Canada (GoC) bond yields were pulled lower last week by their US Treasury equivalents, as per my Highlight section above.

The downward pressure on GoC yields has caused some lenders to reduce their fixed mortgage rates, and I expect others to follow.

Variable Rates

Variable-rate discounts held steady last week.

Unlike the Fed, the Bank of Canada (BoC) doesn’t have a dual mandate. It focuses solely on maintaining price stability. Inflation is lower in Canada than in the US, but it is still above the Bank’s 2% target.

The BoC also meets this Wednesday. When it does, it must weigh the risk that our above-target inflation persists against the risk that our economy slows to a point where below-target inflation becomes its primary concern (because the Bank must equally account for that risk).

Most market watchers think the BoC has seen enough emerging weakness in our economy to cut by another 0.25% this Wednesday.

Bond-market investors are pricing in about 90% odds of that happening. Barring any surprises in the new inflation data, which Stats Can will release tomorrow, I concur with that view.

Insider’s Tip for Borrowers

A borrower’s credit score can impact both the options and the rates that will be available to them.

If you pay your bills on time and don’t get over-extended, your credit score is probably fine. But if you have any blemishes, there are some simple and straightforward steps you can follow to improve your score.

To learn more, check out this post: Eight Ways To Improve Your Credit Score.

My Take on Today’s Most Popular Mortgage Options

My thoughts are unchanged from last week.

Fixed rates have now returned to their long-term average levels.

Right now, the best available three- and five-year fixed rates are both good options. If these rates remain roughly equal, I think five-year fixed-rate terms offer slightly better value.

I continue to believe that today’s variable mortgage rates will likely produce the lowest borrowing cost over their full term, and BoC rate cuts now appear imminent.

Anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and, in some cases, higher payments) should my forecast prove incorrect.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.