Credit Reports: Your Financial DNA

Imagine if your car insurance company knew exactly how you handle your car, how often you exceeded the speed limit, by how much and for how long. Well thankfully they haven’t figured out how to do that yet but when it comes to how you handle your money, your credit report can measure to that precise level of detail. It’s where all of your personal information is gathered, such as income, debt repayment history, total approved credit limits, credit usage levels and more. This personal history, your financial DNA, is crunched using a proprietary scoring system that assigns you a number between 300 and 900, known as your FICO score (the higher the better).

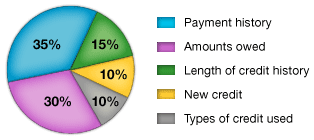

Here is a breakdown of how your score is calculated:

Now I will give you a quick overview of how this works but if you want detailed information both myfico.com and the Financial Consumer Agency of Canada do an excellent job of laying it out for you.

“Payment history” tracks how consistently you have paid back money you owe (credit cards, car loans, gym memberships, you name it!) If payments are missed, the length of time taken to get caught up is also measured.

“Amounts owed” is a measure of how much you owe on different types of accounts and of the proportion of your outstanding balance to your maximum limit. Your overall capacity usage is important because it indicates how close you get to running out of credit each month.

“Length of credit history” indicates how long your accounts have been in existence as well as the time since you last used them. Old debt is not as relevant as recent debt.

“New Credit” measures how many credit inquiries have been made, and how many new accounts have been opened by you in the recent past. This section is looking for ‘credit seeking’ activities where people who are running out of money try to borrow as much as possible to keep afloat.

“Types of Credit Used” creates a score based on the kinds of credit you have. Basically, the harder it is to get approved for a loan, the more the scoring system likes it. Retail accounts are easy to get so they are less convincing. Car loans are more thoroughly vetted so they score more favourably.

With credit report data available for millions of Canadians, trends emerge. Using overall FICO score data, lenders can determine each borrower’s likelihood of successful repayment. Here is a summary of delinquency rates by FICO score (“delinquency” is the term for loans that are 90 days or more past due):

This data is also used by lenders when designing products. They set minimum FICO scores for certain product types, especially in cases where the products are attractively priced or where borrowers do not or can not provide traditional documentation during the application process. For example, a product that does not require proof of income would only be offered to borrowers with a very high probability of repayment (a FICO score of 680 or higher is often the cut-off point).

There are two main companies in Canada that provide FICO scores, Equifax and TransUnion. Both base their scoring system on a proprietary software sold by FairIssac and while the reports are not identical (some companies only report customer activity to one company and not the other) they are usually comparable.

Now that you know how a credit report is calculated and used, you may be wondering what your score is. You can receive a free summary report by contacting either Equifax or TransUnion, and both will provide a full report for a small fee. Most importantly, there are a number of ways to improve your credit report. To learn more, check out my blog post called "Eight Ways to Improve Your Credit Score".