When Will US Inflation Peak?

February 14, 2022The Bank of Canada Is About to Start Hiking. Now What?

February 28, 2022I hope that you enjoyed the Family Day long weekend.

I used the holiday yesterday for its stated purpose, so there won’t be a new post this week. I’ll be back next Monday as usual.

In the meantime, here are links to five key recent posts about Canadian mortgage rates and inflation:

- Canadian Mortgage Rate Forecast for 2022

- The Bank of Canada Will Be Live at Its Next Meeting

- When Will US Inflation Peak?

- Why CDN Bond Yields Surged Despite Big Job Losses

- The Latest Inflation Data Are Not as Bad as You Might Think

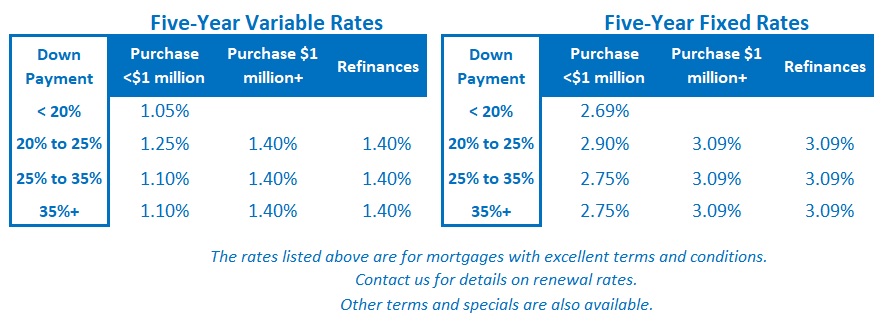

The Bottom Line: The Government of Canada bond yields that our fixed mortgage rates are priced on leveled off last week. Given that, our fixed mortgage rates were mostly unchanged, but their momentum arrow is still pointed upwards.

The Bottom Line: The Government of Canada bond yields that our fixed mortgage rates are priced on leveled off last week. Given that, our fixed mortgage rates were mostly unchanged, but their momentum arrow is still pointed upwards.

Variable mortgage rates were unchanged last week.

I am an independent full-time mortgage broker and industry insider who helps Canadians from coast to coast. If you are purchasing, refinancing or renewing your mortgage, contact me or apply for a Mortgage Check-up to obtain the best available rates and terms.