The Glaring Omission in the Bank of Canada’s Latest Forecast

January 14, 2019Update On the Bank of Canada’s Worry List

January 28, 2019 Last week was a relatively quiet one on the interest-rate front.

Last week was a relatively quiet one on the interest-rate front.

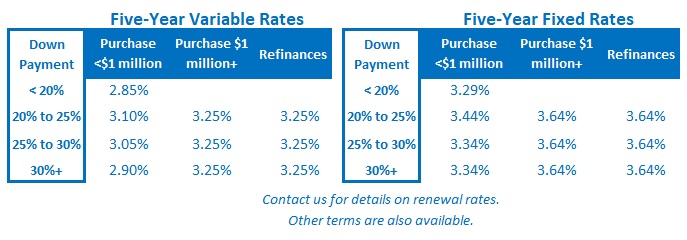

Government of Canada bond yields, which our fixed mortgage rates are priced on, edged a little higher, but five-year fixed rates continued to fall among laggard lenders who had not already lowered to match RBC’s recent cut.

Last Friday we received our latest inflation data, and while it showed an uptick in our overall Consumer Price Index (CPI), from 1.7% in November to 2.0% in December, most of that bump was caused by a spike in the cost of airfares and fresh vegetables. That isn’t likely to cause much concern at the Bank of Canada because its three key measures of core inflation, which strip out the inputs that cause short-term volatility in overall CPI, all held steady at 1.9%.

The Bottom Line: Five-year fixed rates continue to settle in at slightly lower levels and five-year variable rates are holding steady. Hopefully the U.S. federal government shutdown ends soon so the 800,000 affected U.S. workers can receive their back pay and market watchers can get an updated look at how the U.S. economy is faring at what appears to be a critical turning point in the U.S. business cycle.