US Inflation Holds Steady (and So Do Expectations of a Fed Pause)

January 19, 2026 Last week Statistics Canada confirmed that our headline Consumer Price Index (CPI) increased by 2.4% on an annualized basis, up from 2.2% in November.

Last week Statistics Canada confirmed that our headline Consumer Price Index (CPI) increased by 2.4% on an annualized basis, up from 2.2% in November.

Market watchers had expected an increase last month due to a headwind from base effects, which can occur when prices from a year ago roll out of our CPI data set. (Our CPI only measures price changes over the most recent twelve months on a rolling basis).

In this case, the base-effect lift was caused by the temporary GST/HST exemption that began in December 2025.

At the same time, our core inflation measures, which filter out volatile price data to reduce the noise from one-offs such as last year’s tax holiday, cooled once again.

CPI-trim and CPI-median, which are the Bank of Canada’s (BoC) most closely watched core-inflation measures, both decreased in December. (CPI-trim from 2.9% in November to 2.7% in December on an annualized basis and CPI-median from 2.7% to 2.5% over the same period.)

Those core inflation data look even more encouraging when measured over the past 90 days. CPI-trim decreased to 1.5% (annualized) over that period, while CPI-median fell to 1.9%. Importantly, both results were below the Bank’s 2% target level.

There is good reason to expect inflation to continue to cool in the months ahead.

I write that because a further decline in shelter costs, which are the largest component of our CPI calculation with a weighting of roughly 30%, is all but guaranteed.

The methods used to calculate several of its key inputs create long lags, which temporarily understate the impact when there are directional changes in prices.

For example, rent costs are calculated using the data from active leases in place for all tenants, including long-term tenants, and not just the more volatile asking rents for currently vacant units. When asking rents fall, as they are doing now, it takes time for those changes to move average rent costs lower (even as their downward impact is being baked in).

The same type of lag effect occurs with mortgage rates, which are now well off their cycle highs.

According to our December CPI, rents increased by 4.7% in December and mortgage interest costs rose by 1.7%. But over time, based on the changes that have already occurred and barring a sea change in their current price momentum, both trends will help shelter costs, and our overall CPI, cool steadily over 2026.

The Latest on Mortgage Rates

Despite stock-market volatility caused by geopolitical instability, Government of Canada bond yields remained range bound last week.

Fixed mortgage rates, which are based on those bond yields, held mostly steady and will likely remain so until the BoC’s next policy-rate announcement this Wednesday.

There is broad consensus that the BoC will hold steady this week and some speculation that the Bank’s next move will be a hike in late 2026.

For my part, although I don’t foresee any change this Wednesday, I do believe that the BoC will offer a more dovish than expected assessment of our current economic conditions.

I expect the Bank’s communications to focus on our trade uncertainty, a consequential softening labour-market conditions, the (understandable) lack of business investment, and the decline in business and consumer sentiment (which was confirmed in its latest surveys).

If the BoC’s communications do tilt to the dovish side, we could see a near-term drop in GoC bond yields and some concomitant downward pressure on fixed mortgage rates. That response will also bolster my continuing (contrarian) belief that the Bank’s next move will be a cut.

Insider’s Tip for Borrowers

For most of the past decade, Offers to Purchase that included financing conditions have been about as rare as hen’s teeth because home buyers in our hottest real-estate markets had to show up on offer nights with a clean offer to have any chance of success.

But our housing markets are more balanced now, and financing conditions are making a comeback.

To learn more about how they work, and, more importantly, when they should be waived, check out this post.

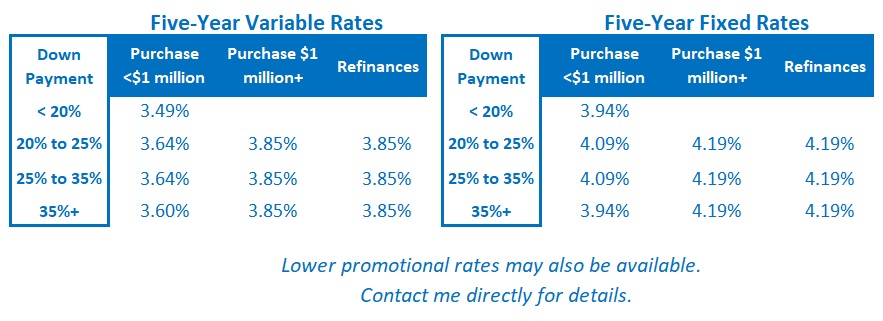

My Take on Today’s Mortgage Options

My advice is unchanged from last week.

Fixed rates are currently offered at about their long-term average levels, and three- and five-year fixed rates remain the most popular choices.

The premium that borrowers must pay to add additional years to their fixed-rate term has been increasing and will probably continue to do so. For now, I think five-year fixed-rate terms offer slightly better value.

I still expect today’s variable mortgage rates to produce the lowest borrowing cost over their full terms (despite my expectation that additional BoC rate cuts over the near term are not likely).

That said, anyone choosing a variable rate should do so only if they can live with its inherent potential for volatility. Borrowers must also have the financial capacity to withstand higher costs (and in some cases, higher payments) should my assessment prove incorrect.

Three Posts Every New Visitor to My Blog Should Read

This post provides a detailed comparison of the pros and cons of fixed- and variable-rate mortgages.

This post provides a detailed breakdown of the very different ways that lenders calculate their fixed-rate mortgage penalties. The amounts charged can vary significantly from lender to lender. A lower penalty can save borrowers thousands of dollars if rates drop.

This post provides a detailed summary of the key terms and conditions to pay attention to in your mortgage contract.