US Inflation Spikes to Its Highest Level in More Than a Decade

May 17, 2021Fixed or Variable? Let the Current Inflation Debate Be Your Guide

May 31, 2021 I hope everyone enjoyed the fantastic weather over the long weekend. I did the same, so today’s post will be shorter than normal.

I hope everyone enjoyed the fantastic weather over the long weekend. I did the same, so today’s post will be shorter than normal.

Update on Increase to the Mortgage Stress-Test Rate

On April 8, our banking regulator announced that the stress-test rate used to qualify uninsured mortgages will be raised from 4.79% to 5.25% on June 1, which I wrote about in this recent post.

Last week our federal Department of Finance confirmed that the stress-test rate used to qualify all default-insured mortgages will also increase to 5.25% on June 1.

This change will reduce every borrower’s maximum mortgage amount by just under 5%.

I’ll be back with my usual more comprehensive update next Monday but in the meantime, here are links to some of my most popular recent posts.

All About Inflation

Inflation is the topic of the day, with most market watchers warning that the current recent run-up is a sign it is about to get out of control.

This post explains why I disagree with that view, and this one explains why I believe that the US and Canadian labour markets will continue to hold inflation back.

The Real Reason the Bank of Canada (BoC) Moved up Its Rate-Hike Timetable

I wrote this post immediately after the BoC’s most recent policy-rate announcement, which included the release of its latest Monetary Policy Report.

My post provides highlights from the BoC’s more optimistic forecast and offers my take on the real reason the Bank moved up its rate-hike timetable.

Why the BoC Won’t Raise Before the US Federal Reserve

This post explains why there is almost no chance that the BoC will increase its policy rate ahead of the US Federal Reserve and reminds readers that the Fed is forecasting that its next hike will not occur until sometime in 2024.

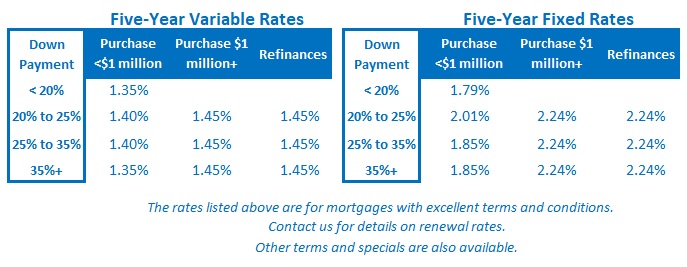

The Bottom Line: Five-year fixed and variable mortgage rates held steady last week. There are no major economic announcements pending for the week ahead, and mortgage rates should therefore stay range bound over the near term.