Has the Bank of Canada’s Policy Rate Peaked?

September 11, 2023Thoughts on Inflation, Bond Yields, Rate-Hike Prospects, and Where Canadian Mortgage Rates Are Headed

September 25, 2023 Last week we learned that the US Consumer Price Index (CPI) increased to 3.7% year-over-year in August, up from 3.2% in July.

Last week we learned that the US Consumer Price Index (CPI) increased to 3.7% year-over-year in August, up from 3.2% in July.

It rose 0.6% on a month-over-month basis, up from 0.2% in July, its highest monthly print since January.

Energy prices accounted for more than half of last month’s total CPI increase, led by gasoline prices, which surged 11% higher.

US core CPI, which strips out food and energy prices, dropped to 4.3% year-over-year, down from 4.7% in July. Core CPI has fallen for five consecutive months and is now at its lowest in nearly two years.

These results were largely in line with the consensus forecast. The overall US CPI was expected to increase because of less favourable base effects, which occur when price changes from last year fall out of the CPI data set, and because of sharply increasing energy prices.

The continued decline in the US core CPI bolstered the belief that the US Federal Reserve won’t raise its policy rate when it meets this week. The US futures market is now assigning a 98% probability that the Fed will hold steady.

There are increasing signs that the eleven rate hikes already enacted by the Fed are increasing their bite. US GDP growth is hovering around 2%, and while the US consumer has been resilient so far this year, the San Francisco Fed estimates that most US consumers have now burned through their pandemic savings buffers.

Other indicators also point to weaker consumer spending ahead.

Credit utilization rates have risen steadily, as have consumer loan delinquencies. On the business side, the bankruptcy rate of US companies has increased steadily for five straight quarters. But just as in Canada, weakening economic momentum doesn’t guarantee lower inflation.

In addition to surging energy prices, US wage costs are still rising in the 4% to 5% range. Those increases, and others yet to come, are being baked in for the next several years as unions demand inflation-adjusted increases that will restore and preserve the purchasing power of their past earnings.

We saw the latest evidence of this ongoing trend last week when the United Auto Workers (UAW) took strike action against the Big Three US automakers (Ford, General Motors and Chrysler). Thus far, the companies have offered a compounded wage increase of 21% over four years, which the UAW is countering with a 40% increase over the same period.

So, in summary, US inflation is still a long way from being vanquished, and I think the Fed will have that very much in mind this week when they meet. I don’t expect them to hike, but I do expect some very hawkish language in the accompanying policy statement warning that the Fed will continue to hike if inflation pressures demand it.

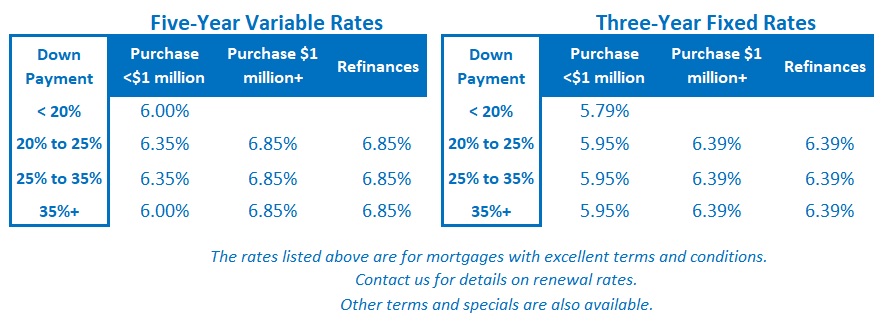

From a Canadian mortgage-rate perspective, a Fed pause will reduce some of the pressure on the Bank of Canada (BoC) to raise their policy rate again, which is what they might otherwise have had to do to staunch the Loonie’s fall against the Greenback. The Bottom Line: Government of Canada bond yields were range bound last week, and fixed mortgage rates were largely unchanged.

The Bottom Line: Government of Canada bond yields were range bound last week, and fixed mortgage rates were largely unchanged.

Five-year variable-rate discounts were unchanged, and if the US Fed decides to hold its policy rate steady, that will increase the BoC’s latitude to do the same.

The latest Canadian inflation data, due out tomorrow, will have a strong influence on where our mortgage rates are headed next. I’ll be back next week with my take.