The Bank of Canada’s Surprising Admission That Ultra-Low Mortgage Rates Are Here to Stay

July 20, 2020Fixed or Variable? Mortgage Rate Forecast: COVID-19 Edition

August 10, 2020I am off communing with nature on a summer break.

My next Monday Morning Interest Rate Update will be published on August 10. In the meantime, here are some of my recent posts that may be of interest (pun intended):

- This post provides links that will be useful to anyone who is actively looking to purchase a property.

- This post offers my take on the Bank of Canada’s latest policy-rate announcement and its surprising reassurances that mortgage rates will stay low for years to come.

- This post outlines a step-by-step process that existing fixed-rate borrowers can use to determine whether they can save money by refinancing.

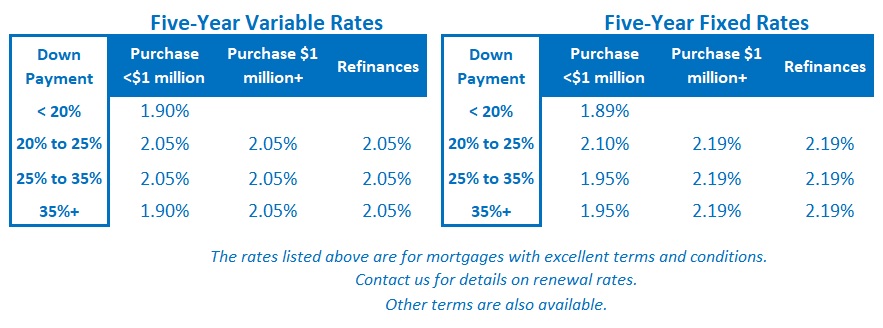

My assistant, Melanie Haggerty, will be available in my absence, and I will update the rate table below next Monday.

The Bottom Line: Variable mortgage rates were unchanged last week, but five-year fixed mortgage rates continued to drop as financial markets adjusted to the Bank of Canada’s lower-for-longer view and as COVID-related risk premiums continued to melt away.

I am an independent full-time mortgage broker and industry insider who helps Canadians from coast to coast. If you are purchasing, refinancing or renewing your mortgage, contact me or apply for a Mortgage Check-up to obtain the best available rates and terms.